If you thought 2020 threw the bike industry into turmoil, just wait until 2021. With manufacturing, shipping, raw materials, delivery, and staffing all getting upended by the pandemic, we’re only now starting to see the true repercussions. From massive shortages to seemingly unbearable delays, get ready for a very weird year.

Here are our predictions for the overall trends in the cycling industry for 2021…

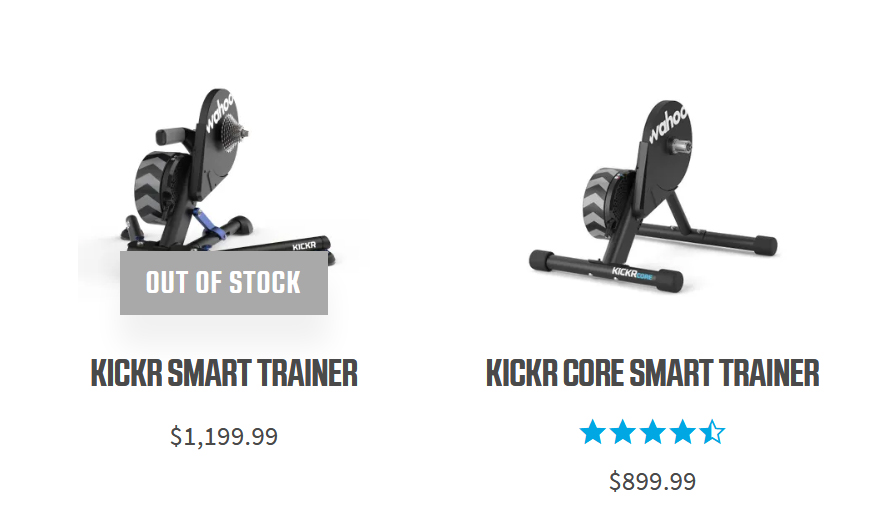

Everything will be in short supply

Thinking about a new bike? New trainer? New drivetrain? New anything?!?

Better get your order in now. Industry wide, the COVID-19 situation has disrupted supply chains like never before. First, it was the uncertainty, which led many brands to reduce or cancel some orders before anyone knew how the market would react.

Then, demand for bikes (and kits, and gear, and everything) surprised us all, skyrocketing as people stayed home and needed something to do outdoors. Problem was, by that time, the factories had closed down so their workers could stay home, too.

And when they came back? They had such a massive backlog of new orders that many brands are telling us they’re 12-18 months out from receiving their next batch of bikes.

Or, the bikes that are arriving in the next 12-18 months are already completely sold out. Which means the shops might have inventory on the way, so you should definitely talk to them about what they’ve ordered and put your deposit down now…then realize that whatever delivery date they promise might get pushed back a few times (and it’s not their fault).

Why? Because global delivery systems are incredibly backed up and strained. There are also limited hours and staffing at some warehouses and distribution centers, at least until we get nearly complete COVID vaccinations and people can safely return to work.

The same constraints apply for drivetrains, components, suspension, etc. Pretty much everything you will want or need for your bike in 2021 will be in short supply…if it’s available at all.

Only a few new models will launch

Take all of the reasons above, then add the need to create new tooling, molds, or push test mules through an already overworked R&D lab.

For big brands that have the ability to build prototypes and test them in house, we may see a few things. After all, their product launch cycles often run 2-3 years long, so whatever they were planning to launch this year was likely conceived of and started in 2018 or 2019.

Smaller brands will suffer most because smaller orders typically get pushed back at some factories. Brands like Parlee (and most of the folks who exhibit at NAHBS and Philly Bike Expo) will have to worry about raw materials and components, but shouldn’t be set back quite as much. If you’ve been considering a custom bike, today might be a really good time to get your order in!

Generally speaking, in 2021, we bet a number of major (and minor) brands delay their launches for weeks or months because they’re waiting for inventory to arrive. And that cycle is going to get worse before it gets better.

We might not see new brands launch, either

Or, at least, probably not very many of them.

Why? Because if you’re a startup and you’re trying to get onto the production line at an Asian manufacturer, you’ll be behind all of the other companies that already have relationships with them. And already had standing orders. So, unless they’re manufacturing elsewhere (or in house), any 2021 launch plans might be way, way behind schedule.

Even domestically made parts are going to be hard to get

It’s not just bikes and stuff shipping from Asia. Parts that are made in house, like those from White Industries, Chris King, Industry Nine, One Up, Wolf Tooth, Cane Creek, Push Industries, etc., are all reliant on the raw materials and supply chains, too.

They have an advantage in that they are mostly already back at full production levels, and many (but not all) raw materials suppliers have reportedly caught up, especially if they’re sourcing domestically, too.

But, because their foreign-made competitors are sold out or backordered, these brands have seen sky high demand throughout 2020. So, some of them are sold out and backordered, too!

It may not immediately jump out as obvious, but “domestically manufactured” includes foreign brands like Campagnolo, Rotor, Mason, Intend, Ingrid, etc. Regardless of where they’re shipping the parts or frames, they might be easier to get. Except…

Brexit will complicate things… for now

On top of pandemic related delays and issues, now the UK and EU are dealing with the repercussion of the latest Brexit deal. More than anything, many brands are having to take a wait-and-see approach as they struggle to make sense of the new rules.

That’s led brands like Cotic to post Brexit-related updates on their sites to provide as much information as possible to consumers. Cotic’s Founder Cy, states that “At the moment, Brexit is simply eating up a huge amount of time and energy trying to find answers to questions about how the new rules are to be applied, mainly because the agreement was so rushed, so last minute, and so lacking in detail.”

Much of the possible Brexit-related side effects for the bicycle industry are a direct result of where the product is actually manufactured. Joe McEwan of Starling Cycles (above) points out that the Zero Duty condition for trade with the EU applies only to products made in the UK, so Starling cycles aren’t subject to the same import duties as bikes manufactured in Taiwan, China, or other countries.

Joe states that, “In the short term Brexit has caused me a real headache with having to return VAT to EU customers and prepare more detailed shipping documentation. But in the long run, this is no more difficult than shipping frames outside of the EU, which I do for many of my frames.”

He continues, “The biggest impact will come in the longer term. I expect the cost of everything in the UK to go up, the added complication of shipping and dealing with the EU will add cost to all aspects of doing business between the EU and the UK. I’ve already been made aware of impending steel price increases. Shipping prices have already gone up.”

However, Forbes is reporting that Brooks England, which makes its legendary saddles in Smethwick, West Midlands, has been forced to at least temporarily suspend sales to customers in the UK. What? Apparently, their saddles are first shipped to their logistics center in Italy, and then shipped back to customers in the UK, which is why they’ve had to press pause until Brooks can figure it all out.

Already, Rose (a German direct-to-consumer bike brand) has said they will stop selling bikes into the UK. Citing UK rules about having to mount the front brake to the right side, they’ve opted to simply stop selling there in favor of streamlining their assembly process for the entire rest of the world.

There are some companies, like Parcours Wheels and Peaty’s, who feel that Brexit will have less of an impact on their daily operations. Dov from Parcours points out that it might be hard to separate the impact of Brexit from that of the Pandemic, which has already caused massive shipping headaches and crazy increases in shipping costs. Dov believes that as long as the foreign exchange rates remain stable, that their business with UK, EU, and US customers will remain relatively unaffected.

Peaty’s says that because they’re manufacturing in the UK and selling through distributors versus direct to consumer, that their pricing will remain stable in the EU. But brands that sell direct may see their consumer pricing go up because of new taxes.

The takeaway?

It’s complicated. While it may be business as usual for some customers and products, others could become completely unavailable or more expensive – depending on where you are in the world, and where that product was created or shipped from. Realistically, this seems like it couldn’t have come at a worse time for many brands (and customers as a result) who were already struggling with product shortages and skyrocketing shipping costs as a result of the pandemic.

Online retailers will finally get rid of older bikes

This one’s more of a guess, but all of those one-, two-, and three-year prior model road, gravel and mountain bikes you keep seeing for 25% to 40% off on JensonUSA, Competitive Cyclist, etc.? They’ll probably finally sell out.

Because when we can’t get a new bike because all the reasons above, we might realize that the stuff from just a couple years ago is still perfectly good (just make sure it has the latest standards… check here for tips on buying a fully modern road, gravel or mountain bike!). And it’s even better when it’s nearly half off!

Elsewhere, though, we doubt you’ll see much discounting. Because why put something on sale when it’s already selling out?

What do you think?

Over the next couple days we’ll share our predictions for Road/Gravel Bikes and Mountain Bikes. But for the industry in general? What are your thoughts? And check out last year’s predictions if you’d like to see how we fared despite 2020’s madness.