Every year, coverage of the North American Handmade Bicycle Show is dominated by beautiful photography of show-stoppers and observational commentary. While that’s great for folks who love flipping through galleries, for me it’s an opportunity to go deeper.

So this year, rather than walk the show with the purpose of telling individual customer and builder stories as I typically love to do, I set out to answer a question:

What is the North American Handmade Bicycle Show in 2019?

To answer this question I designed a meaningful and attainable data set given the show environment, a system with which to capture the data, and then I hit the show floor with the goal of documenting every complete bike at the show.

Why?!

Why would one elect to spend all of NAHBS moving bike to bike like a frowny hummingbird, isolated from the world with headphones and a killer playlist, taking furious notes rather than engaging with the many fascinating personalities at the event? The builders are the best part!

A few reasons.

While a data profile on a single bike isn’t as romantic as, say, a good origin story or a knock out photo (Tyler’s ongoing coverage handled that), a collection of data profiles from a show can tell all sorts of interesting stories. Series of collections can show you trends through time and space, because once you’ve created a data set, you can compare it against others (in this case, we’ll be able track NAHBS from year to year, or compare NAHBS to other handmade bicycle shows internationally).

But this information isn’t just interesting for enthusiasts within the independent segment of the cycling industry – it is incredibly helpful for anticipating future trends in mainstream industry.

The independent frame builder community is able to exist and thrive because it meets needs of consumers that aren’t being met by the mainstream cycling industry, whether those needs are around styling, technology, fit, purpose, materiality, etc. Folks will pay more, wait longer, and be happily inconvenienced for product from independent frame builders because they address these unmet needs. The North American Handmade Bicycle Show is the biggest exhibition of this unique needs-meeting product in the world.

As a result, NAHBS is a popular event for members of product departments of the mainstream cycling industry, who walk the show and openly take pictures and notes – and themes in product solutions from a given NAHBS are often echoed in more mainstream product a year or so down the line. You can also watch as new segments seem to hatch within the independent builder community, are refined and developed there, and then, when proven viable, are adopted and pulled through to mainstream industry product lines. Fat bikes and gravel bikes are notable recent segments to have developed in this way.

But outside of wanting to observe trends over time and to see into the future, I wanted to test my own preconceived notions of what the event actually is. Because there are so many exceptional machines and gifted marketing and public relations consultancies vying for attention at the event, it is very easy to miss most of the show for a few exciting bicycles.

Process

If you’re not into this stuff, I won’t be offended if you skip ahead. I just want to make sure folks know where I’m coming from before we dig in.

As I wanted to cover as much of the show as possible, and because no one could give me a real number as far as how many bikes were actually at the show (I was quoted 220 complete bicycles, tops… I estimate that that number was closer to 330 this year), I kept the data set pretty modest in scale and prioritized complete bicycles by established builders displayed in those builders’ booths (rather than in component company booths). Sorry, new builders, I’ll catch you next time.

While there was a temptation to gather all the data so that I could swim around in a pool of it after the event like Scrooge McDuck, I had to make some tough decisions. What’s interesting to me isn’t necessarily interesting to anyone else (example: I talk about steel chainstay evolution at parties – ask my very bored friends). I prioritized data that is meaningful for a wide range of readers, that comprehensively translates across genres and materiality.

Also, knowing that I could move quickest if I could keep questions to the builder to a minimum (because builders are usually busy talking to show attendees at these events), I designed the data to be able to be captured by “expert” observation alone. Though I managed to get my data entry time for a single bike under two minutes, I ended up spending more time both out of interest of the bikes and because taking data at a sprint is mentally taxing and unsustainable, as it turns out.

In all, I was able to document a total of 265 bicycles. I can say without question that I saw more of the show this year than anyone else – and it was the hardest NAHBS I’ve ever had. But boy howdy, did I learn a lot… and I am so stoked to show you all what I see.

“The Overalls”

For best results, pause a moment to meditate on your pre-conceived notions of this event, either from your personal experience or from what you’ve gleaned from existing coverage. What standards are prominent? What types of bikes are dominant? What materials are most common? What is a typical NAHBS bike in your mind?

Do you have the idea in your head? Good.

In this first installment of NAHBS by the NUMBERS 2019, I’ll introduce the high-level data and its context so you can have an understanding of what it is for when we dig deeper into trends on use case, technology, styling, etc. in future days.

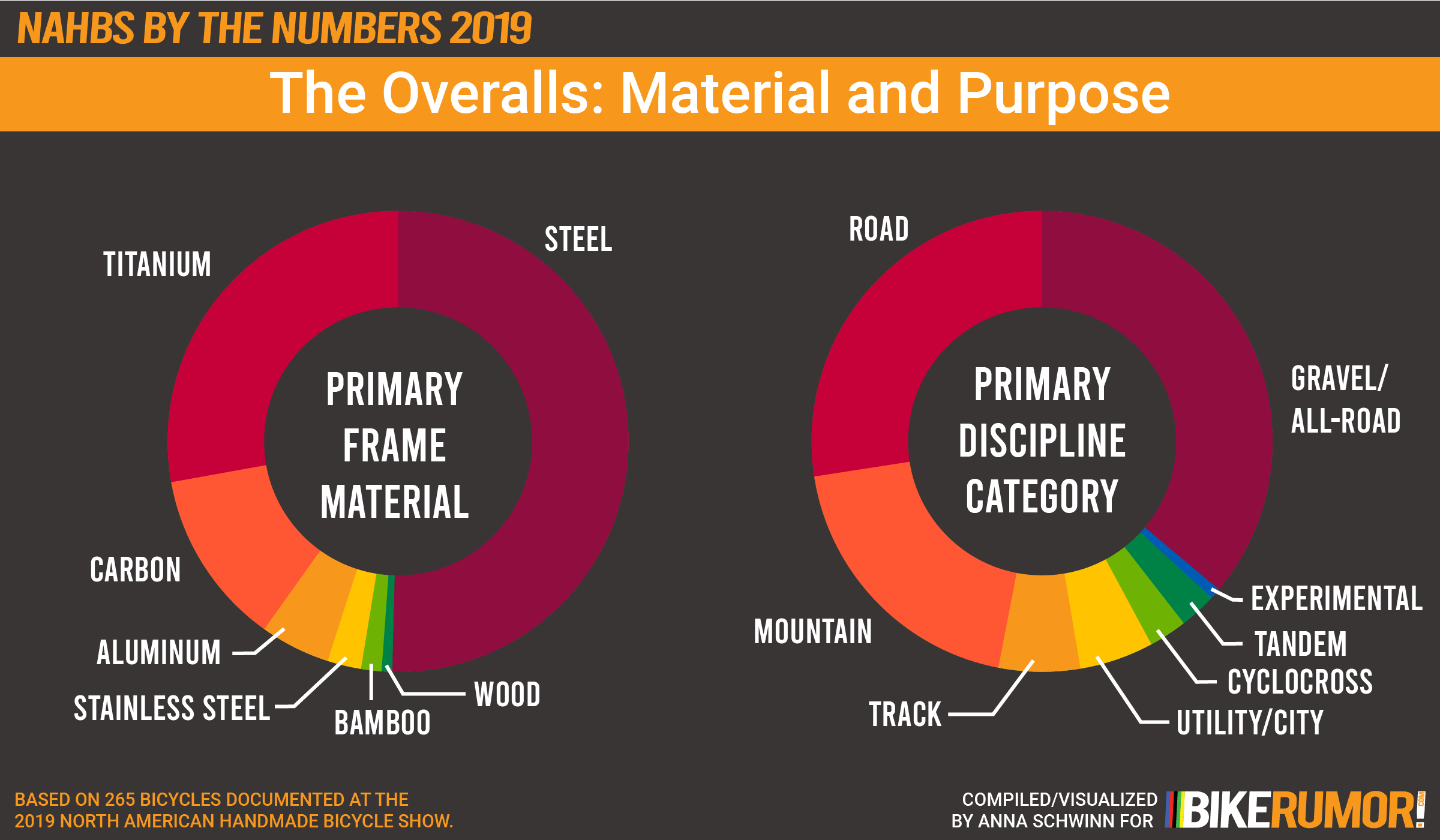

Primary frame material refers to the main material of each frame. In cases of multi-materiality, the main material of the front triangle was documented.

Primary discipline relies on NAHBS event terminology for classification. The line between Road and Gravel/All-Road was determined by whether or not a road bike was designed with intent for mixed surface usage.

Interesting notes on this graph: since the Gravel/All-Road-specific segment has grown in prominence, cyclocross-specific bikes at the event have dropped. This could be partially due to the technological advances within gravel-specific tires and components that addressed the use case of gravel more effectively than cyclocross bikes (which were common at gravel events five to ten year ago)… and partially due to the fact that builders often bring recently built bikes. Gravel season is just about to jump off and bikes for cyclocross season won’t start for months.

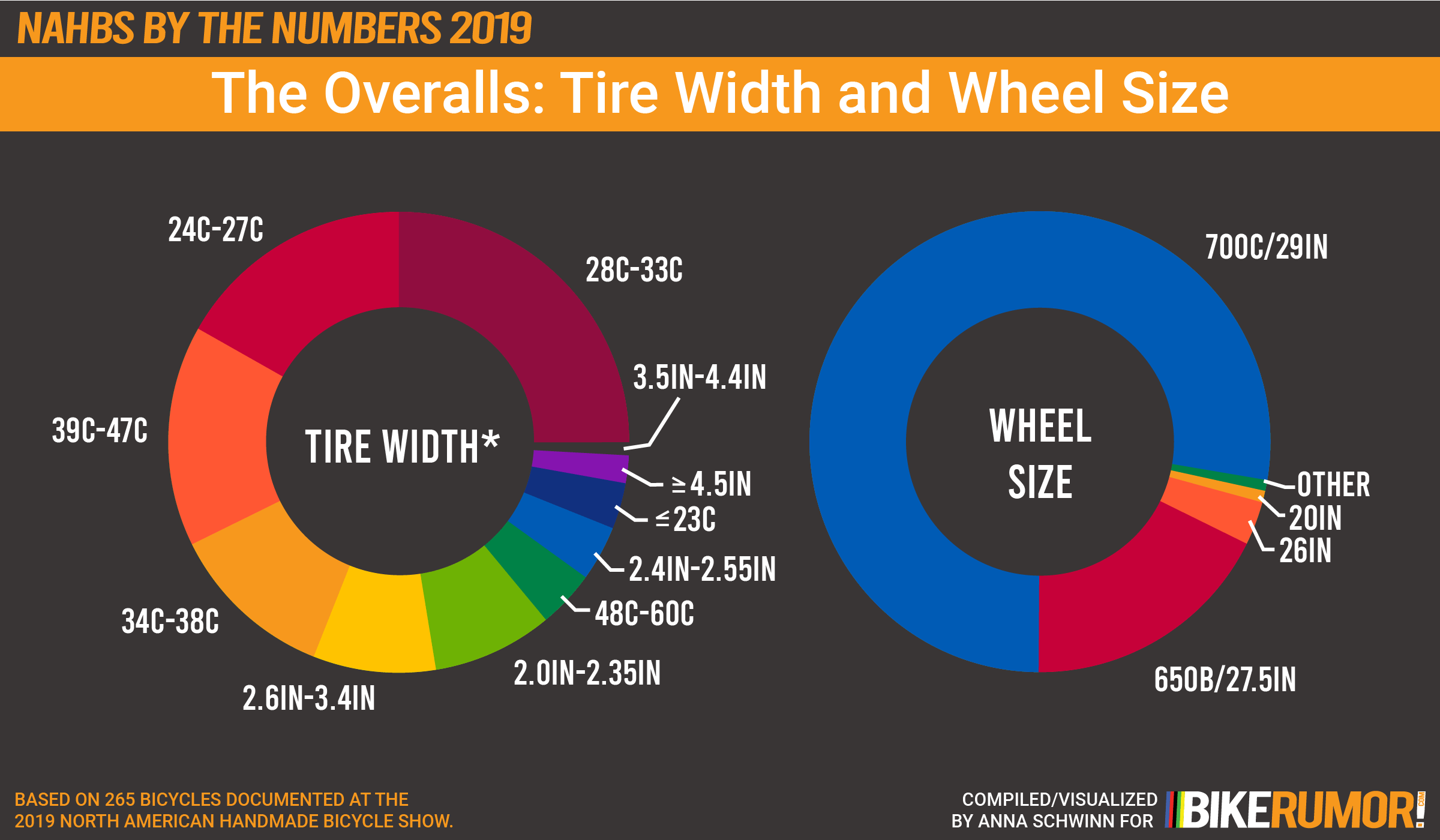

Tire standards are all over the place. If I were doing this the way I wanted to, I’d be measuring tires and rims, documenting both specifications, and talking about tire/rim system trends. But this wasn’t a tire and rim project and time was limited. Again, compromises were made.

To expedite record-taking of tire widths on the show floor, data such as tires sizes were divided among size ranges aligned with riding use case. I used ‘C’ designations rather than millimeter on the road tires (sorry, Brad, I can actually feeling you crinkling up like a can reading this); when tire tags are all consistent, I will be as well.

Also, yes, I am aware that there is overlap between 48C-60C and the 2.0in-2.35in tires. This was done intentionally, after several days of debate among expert friends, to reflect how the tire was labeled by the tire company as well as the purpose of the tire.

The big surprise for me was that there were more 23mm and under tire bikes than there were 4.5in+ fat bikes. Just saying. Fat bikes were pretty rare on the show floor.

As far as wheel sizes, the surprises were in the small end. There were two mini-fat bikes in attendance in 20in, at Hunter Cycles and Dear Susan.

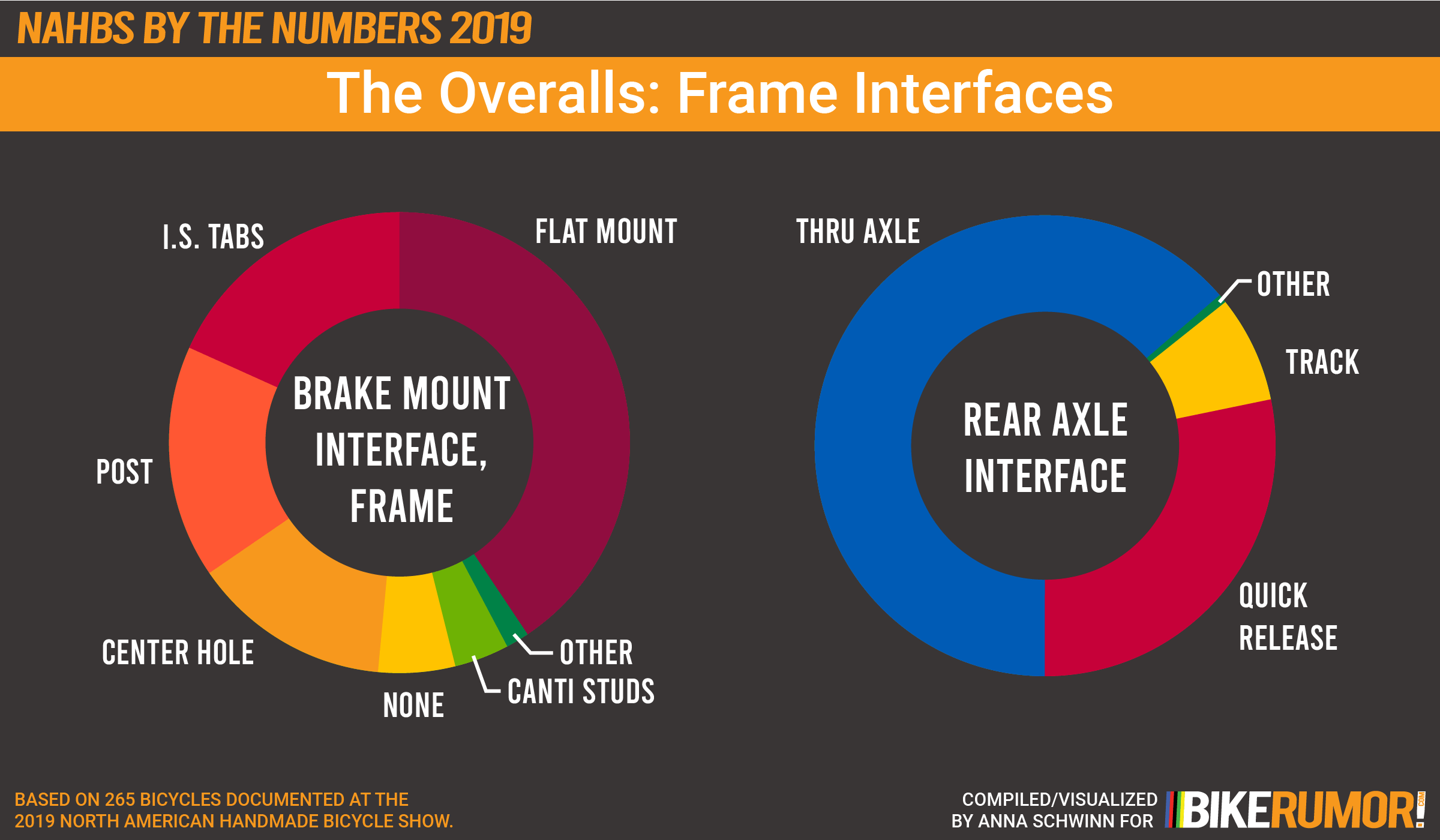

For this portion, I wanted to focus on the standards of frame-brake interfaces themselves, rather than the standard of the brake installed. It’s from this chunk of data that you can determine that disc brakes appeared on 76% of bikes examined from the event.

Thru axles appeared on 64% of the frames examined – and felt like an invasive species if your terminal axle technology is the quick release, which made up a measly 28% of documented bikes.

A delightful surprise both at the event and in the data is the strong presence of proper, no brake, competition track bikes thanks to a recent surge in popularity in both velodrome track and high-profile fixie crits.

Because who doesn’t love seeing a brand split? It should be said that The Other category of Brand, Braking Mechanism consists primarily of Magura calipers, and one set of Promax brakes.

Hydraulic brakes surpassed mechanical brakes, 58% to 36% – this is definitely a case where I would have loved to see the numbers from the last five or so shows and how this particular technology has evolved.

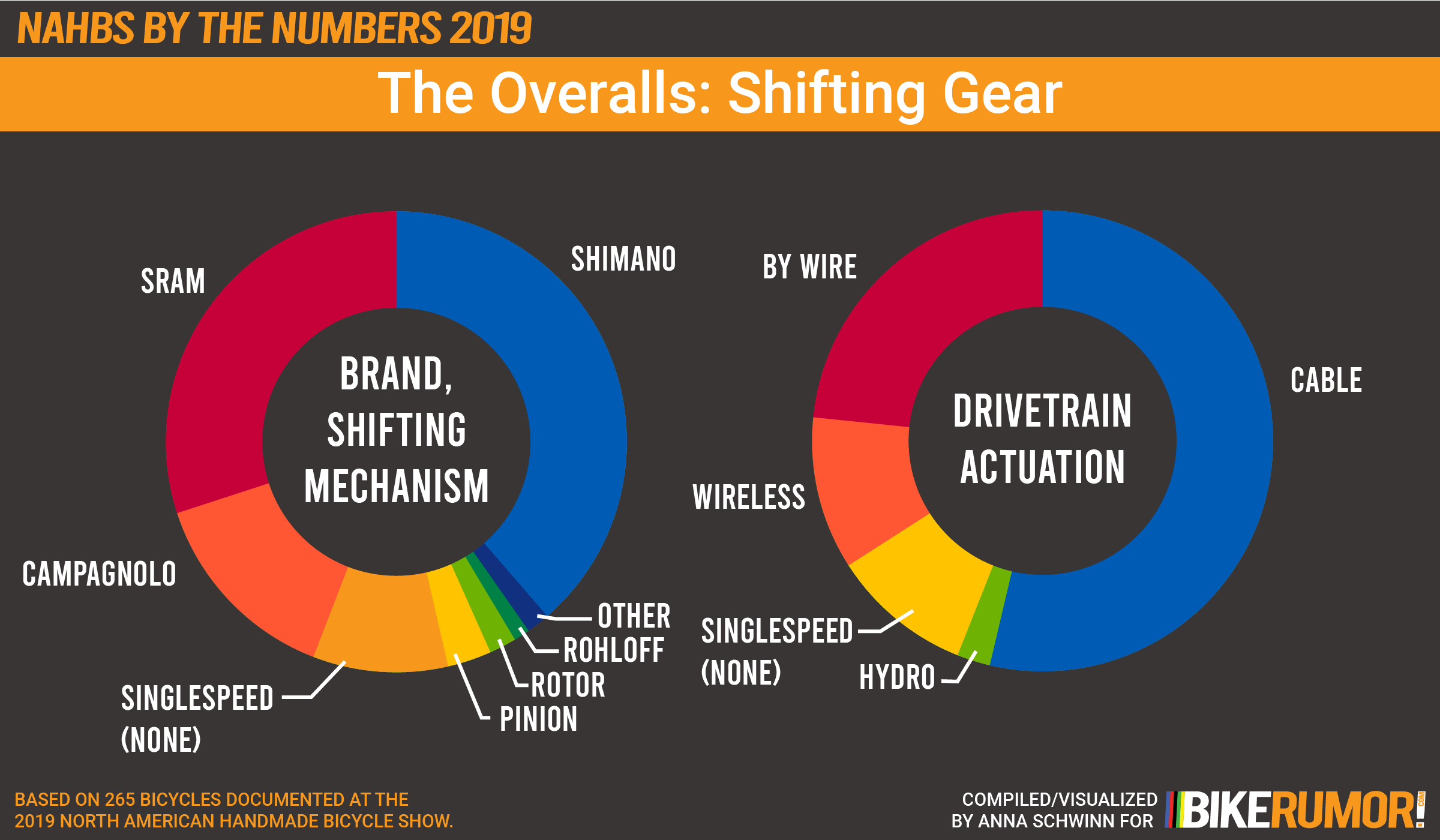

Last but not least: changing gear. As in brakes, Shimano is dominant in this arena making up nearly 39% of shifting mechanisms counted.

Electric wireless or by wire systems came in at 34% of bikes examined, with cable actuated systems making up 54% of bikes counted.

Having Said All This – A Disclaimer

It’s important to say at this point that the North American Handmade Bicycle Show is a very different show from year to year due to location and trends. A show in California, for example, is more physically and financially accessible to west coast builders than it is to, say, builders in the upper midwest or east coast (and we’ll get into regional trends more later). As a result, data acquired this show is heavily influenced by geography, local infrastructure and frame building lineage, and use case emphasis.

Also, NAHBS features very different bikes and trends than shows such as the Philadelphia Bike Expo or Bespoked on any given year.

So while this is the largest exhibition of independent frame builders on the planet, it is far from representative of the whole of this segment. Be conscious of that as you read forward.

With that out of the way: I can’t wait to show you how this all breaks down in the coming posts. This is the kind of thing I’d love to read and see, so I really hope you enjoy it.

Part 2: NAHBS by the NUMBERS: Summaries by Discipline

Part 3: NAHBS by the NUMBERS: Fashion and Style

Part 4: NAHBS by the NUMBERS 2019: Regional Themes, Steel Construction