Welcome to our fourth installment of NAHBS by the NUMBERS 2019, our analysis of the North America Handmade Bicycle Show. One of the ways NAHBS keeps the show fresh each year is through changing location. Because we don’t have a set of data from past years to compare against, I thought it could be cool to dig into regional themes of bikes at the show. But that’s not all – for my friends of ferrous metal, I also take a look at steel forks and frames.

Read on!

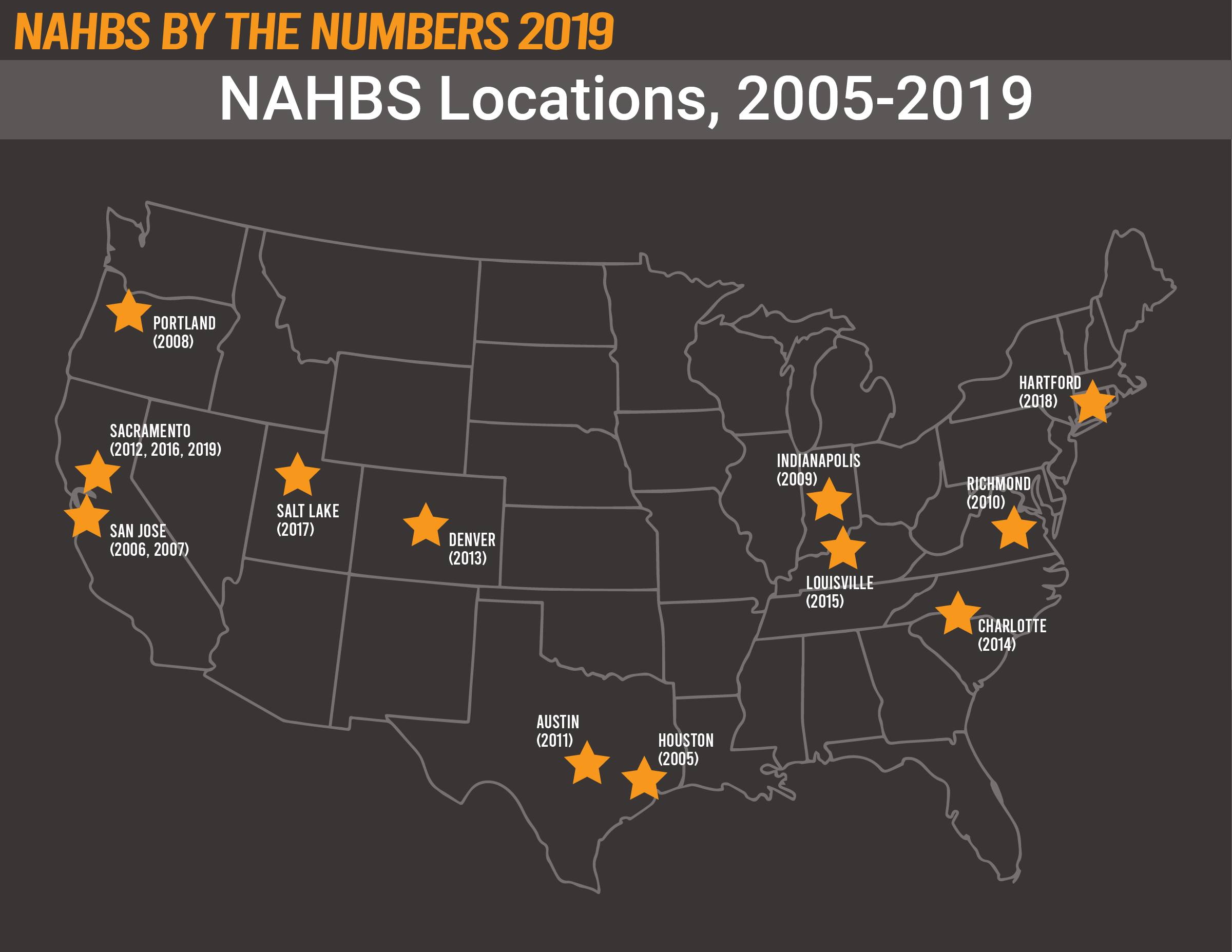

One of the things that makes NAHBS unique is its movement. Rather than pick a city and/or venue and invite folks to come to it, the show travels to different cities, making the show and the independent segment accessible to folks in those cities.

Because the mobile nature of the show is so central to what NAHBS is, I felt it was extra important to look at regional themes and to examine how location influences a show’s make-up. With this data captured, we can examine future years in relation and paint a picture of NAHBS by region.

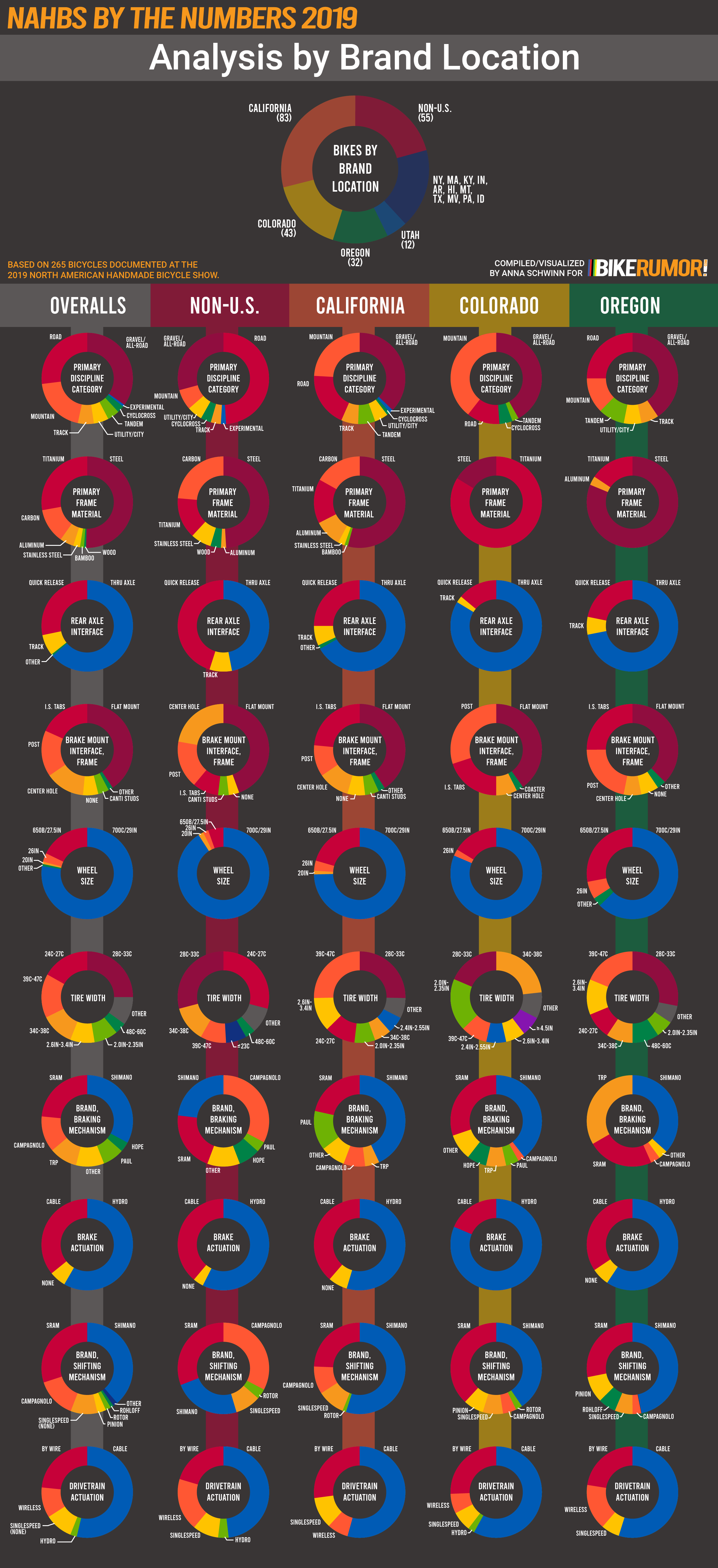

For this, I examined locations of brands, pulled data from the three states who brought the highest number of bikes, and grouped all international bikes together.

First observations. The biggest states from a bike perspective all happen to be about a day’s drive from the venue – not surprising because it’s pretty easy to load up a van or trailer and drive up to the show with a lot of bikes. It could be that because flying in requires more money, planning, and careful packing than transport via driving, so folks coming in from further away tend to show with fewer bikes.

For builders traveling in from outside the US, different locations come with a unique set of challenges. A show in California was going to be relatively simple attend for folks overseas (thanks to the international focus of both LAX and SFO airports). As a result, there was a good international showing. Italy and the UK were particularly well represented.

But Anna! Why have you grouped Canada with international builders rather than with the North American builder data? Why?

Well, reader friend, two reasons. First, while the name of the show is “The North American Handmade Bicycle Show,” the show has never left the US. Second, the US has specific infrastructure and product and riding trends that aren’t necessarily shared with Canada.

Analysis by Brand Location

With this all laid out, you see some pretty interesting things at play. Here are a few things that really jumped out at me.

Roadie Trends in Non-US Bikes

Bikes coming from outside the US where very different on the whole than their domestic counterparts. They skew road, with heavy traditional road themes such as traditional rim caliper brakes (mechanical of course) and quick release skewers. There is also a notable preference for Campagnolo brake and drivetrain product overall – something I’ve observed in bikes and offerings at handmade shows outside the US.

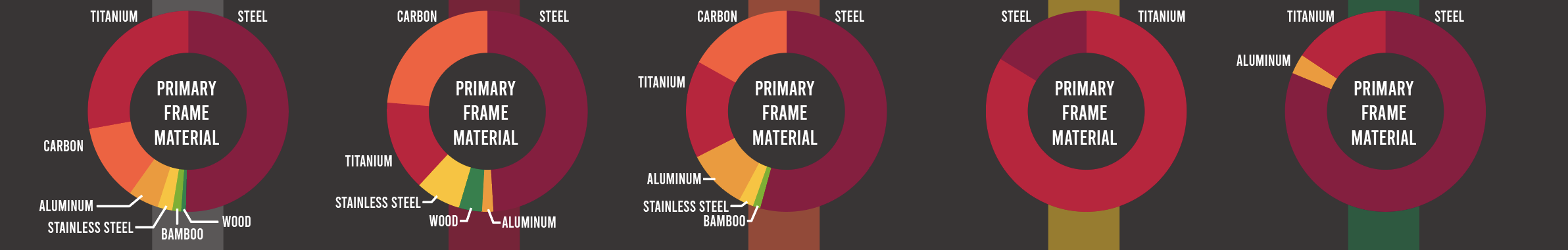

Materials by Location

The first thing that jumped out at me about this data set was how location seemed to influence material usage.

Colorado, seen above second from the right, brought mostly titanium bikes to the show. While initially a little startling, this high number of titanium bikes makes total sense given the infrastructure and expertise in that region for advanced alloys. With heavy hitters such as Black Sheep, Mosaic, DEAN, Bingham, and Merlin in the region, and many builders coming out of those establishments, you can get the sense for how this pattern in material will continue to perpetuate itself.

With that noted, you’ll see that carbon bikes counted were more common than titanium in the count in places like California and outside the US. Oregon, in contrast, is nearly the opposite of Colorado, with steel beating out titanium in almost equal proportions.

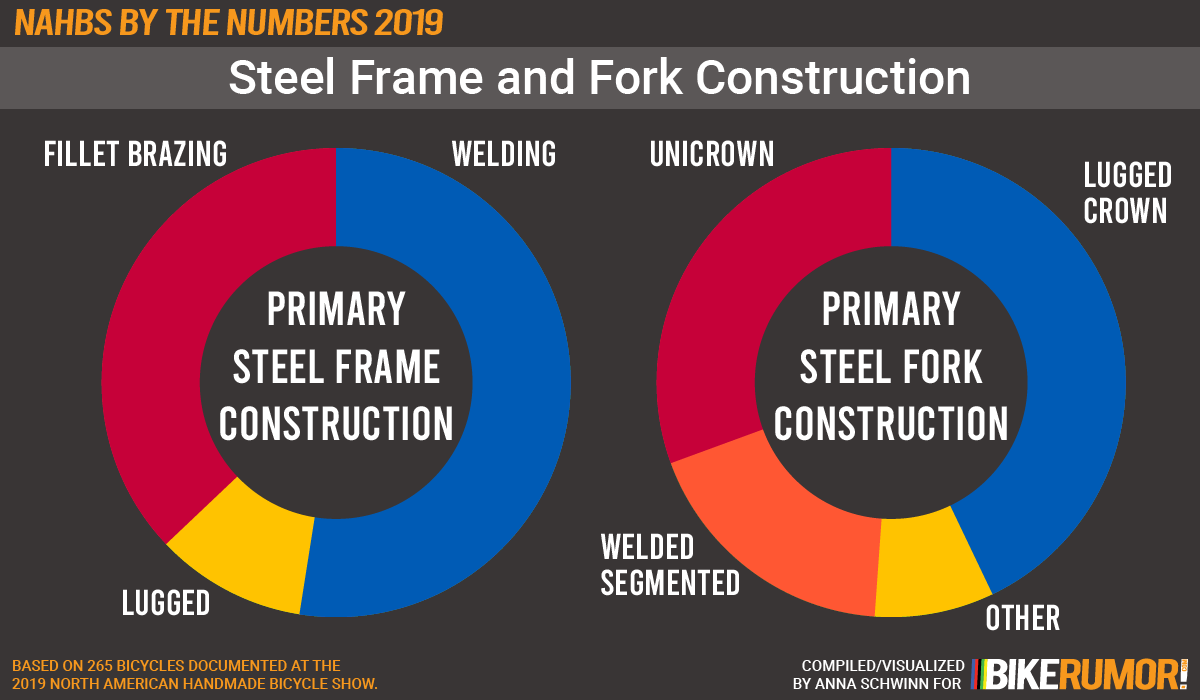

Steel Frame and Fork Construction

This is a good measure to take year to year – steel frame and fork construction is an interesting trend to track. Fans of NAHBS can reflect back to the intricate custom lugged bikes that used to dominate at shows such as NAHBS 2011 in Austin (at that time, fillet brazed frames were super rare).

This year, I took a quick read on the primary construction approach of frame and fork. This was tricky to do because often steel frames are made by a variety of processes in combination. I looked at the main triangle and made a call. In cases of blended construction (several builders did partial bilaminate joints with fillets – in those cases, I prioritized fillet brazing because that theme pulled through on each joint and bottom bracket joint).

Lastly, I took a temperature on steel fork production, mostly because I feel that fork construction is a trend that changes with bike fashion.

I also took data around steel forks. With Anvil Bikeworks rolling out a new double fork blade bender in 2017, I’ve been interested to see if adoption of that fixture by independent builders has increased the number of steel forks on product. With this baseline, we can now understand how this changes through time, if it does.

And with that, look forward to our final installment of NAHBS by the NUMBERS 2019 – there is a big, fabulous finish to this project. I hope you enjoy it.

If you want to read or re-read pieces in NAHBS by the NUMBERS 2019, you can find them here:

Part 1 NAHBS by the NUMBERS 2019: The Overalls